Aperture Data Studio in Telecommunications

Protecting revenue and customers with trusted, actionable data

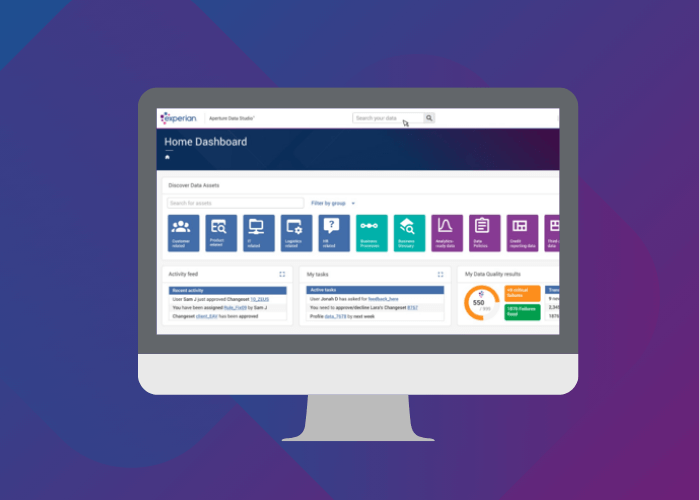

Aperture Data Studio empowers organisations to deliver trusted data. Our intuitive, quick-to-deploy, and transparent data intelligence platform includes robust data quality and governance capabilities to help you improve, control, and govern your data.

It enables everyday users to quickly and easily develop sophisticated workflows that incorporates machine learning algorithms for automatic data tagging and enriches the data using globally-curated data sets from Experian. This ensures data quality and helps govern adherence to data standards.

Break down silos across CDRs, IPDRs, SMS logs, subscriber records and billing systems. Create a single, analytics-ready environment to support accurate credit assessments, fraud detection and debt recovery.

Streamline the extraction, formatting and validation of data required for regulatory reporting and scam intelligence sharing. Ensure consistency and reduce manual effort under the upcoming Scam Prevention Framework.

Cleanse and validate customer data to eliminate duplicates, detect anomalies, and reduce friction during onboarding. Improve KYC accuracy and reduce the risk of fraud and account takeover.

Feed clean, governed data into AI models to detect suspicious patterns—such as login anomalies, unusual account changes, or high-risk transaction behaviour—at scale and in real time.

Use high-quality, complete data to enhance the accuracy of debt provisioning models. Better understand collectability and credit risk exposure to support financial planning and reduce bad debt.

Implement robust data governance, lineage, and audit trails to meet obligations under AML/CTF, ASIC, ACCC and scam prevention regulations. Show regulators that “reasonable steps” are being taken with well-governed data processes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.