Streamline the loan application process

Today’s borrowers want an easy and fast credit application experience, and expectations are high – for example, Experian research revealed 75% think a home loan application should be processed within 3 days, however almost 70% are taking more than 2 weeks to approve.

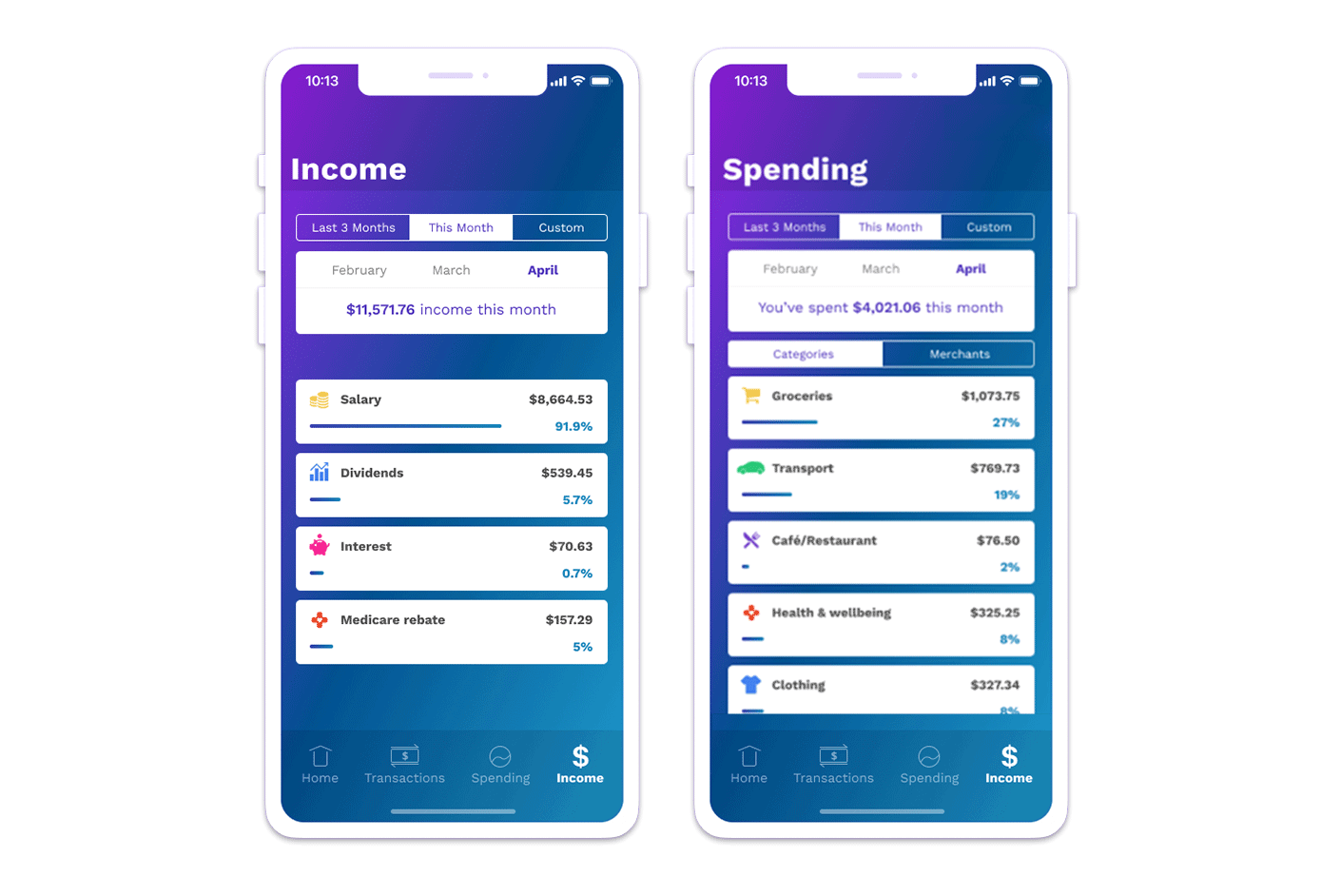

A faster credit application process can be hindered by the inefficiency of manual income and expense declarations. It’s burdensome for customers to collate this information, and time consuming for lenders to assess it.

Using Experian’s super-fast APIs, you can automate the identification of income and expenses. Save your customers time with pre-filled information, reduce application form drop off and facilitate a faster time to ‘yes’.

Talk to us