Streamline the collections process

As the cost of living reaches new heights, the strain on household budgets could put more borrowers at risk of hardship.

With Experian’s Risk Radar Report revealing two thirds of lenders acknowledged poor lending decisions could put their customers into financial hardship, lenders may find themselves caught between a rock and a hard place - wanting to do all they can to help borrowers achieve their financial goals and avoid facing hardship or defaulting on loans.

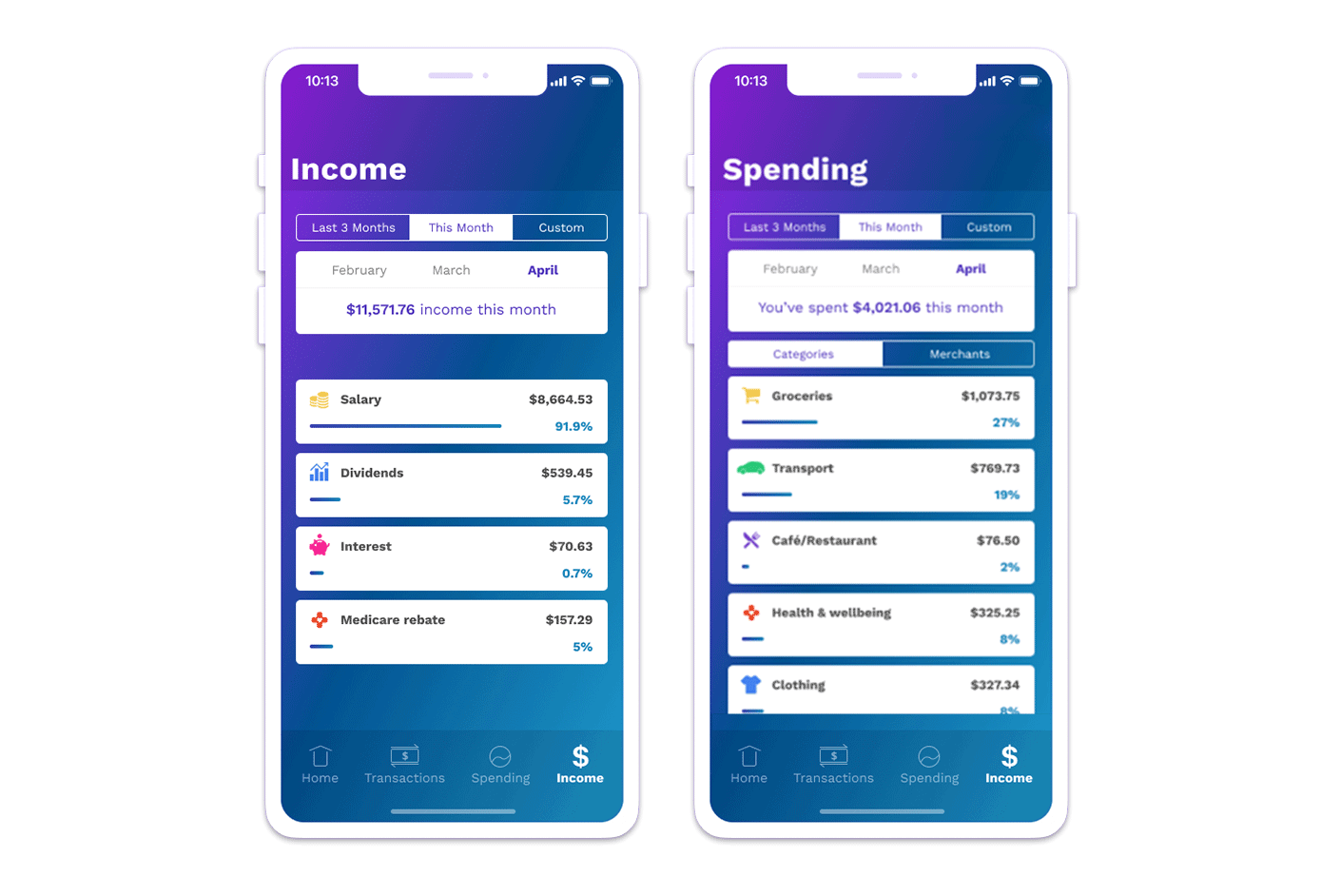

Using Experian’s super-fast APIs, you can automate the identification of income and expenses in your own data to consistently monitor affordability through the life of the loan. This helps you easily identify borrowers showing signs of stress and proactively provide the support they need.

Talk to us