NOW Finance, a consumer lending provider specialising in personal and auto loans, collaborated with Experian to solve a critical challenge: defining its target market. By leveraging Experian’s Mosaic segmentation and Credit Demand Index, NOW Finance shifted from broad acquisition tactics to a data-driven brand strategy. This approach helped reduce acquisition costs, improve brand health and create a foundation for more sustainable growth.

See full story >Overview: Thriday revolutionises financial management

Thriday revolutionises financial management for SMEs using Experian’s solutions

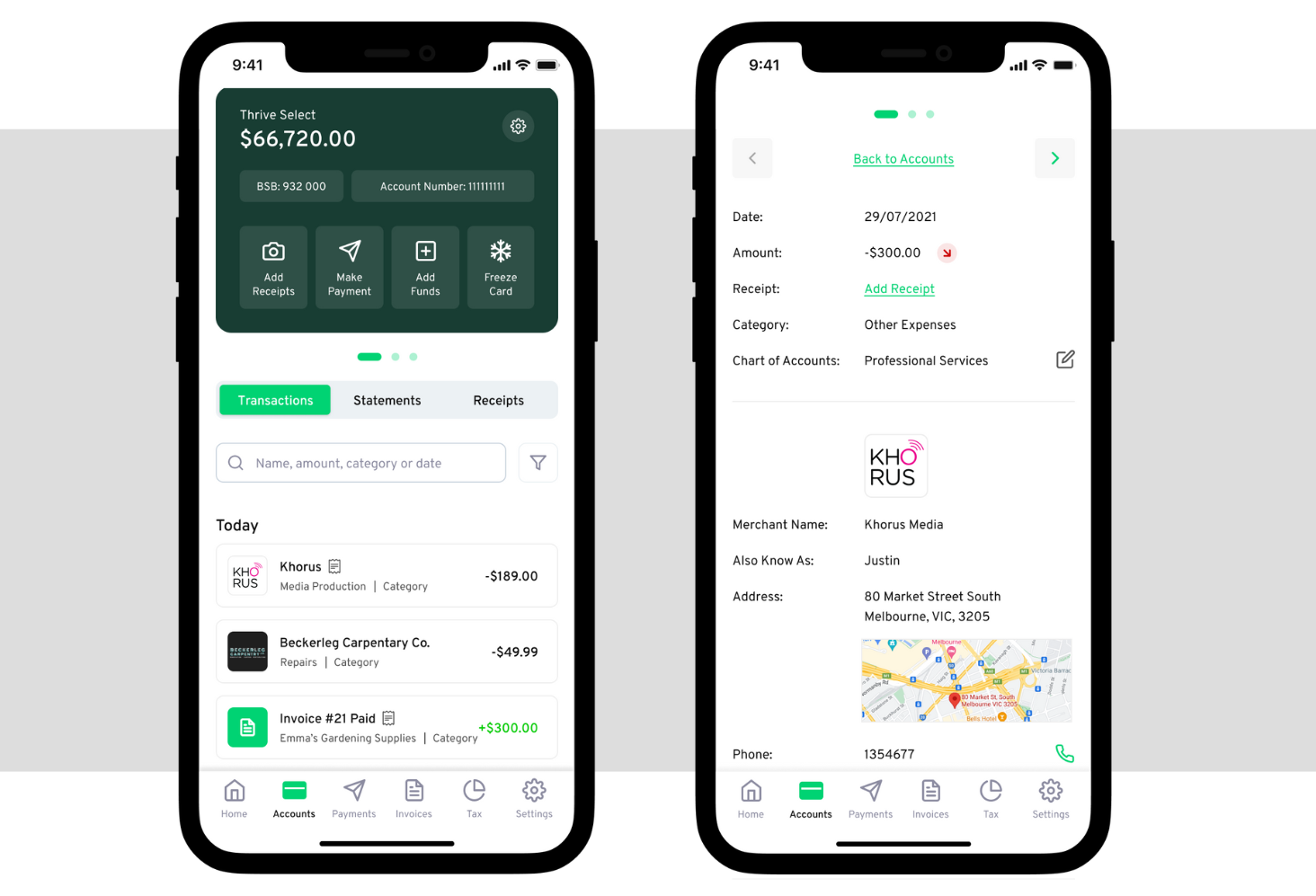

Thriday, a financial management platform for SMEs, has collaborated with Experian to revolutionise financial administration for businesses. Thriday’s unique product automates banking, accounting, and tax for small businesses, helping them save time and costs. The integration of Experian Look Who’s Charging’s technology, which enriches and automatically categorises bank transactions in real-time, has enabled Thriday to offer its customers a more accurate and faster bookkeeping service than human labour. By charging users just $29.95 a month, Thriday has slashed the costs of financial administration for businesses while also saving them six hours of precious time each week.

Challenge overview

Small and medium business owners spend a lot of time on manual financial administration – six hours a week, according to Thriday’s 2020 study. These businesses are also typically unable to afford dedicated financial managers, expensive accounting software or expensive account fees. When cash flow is tight, every dollar saved can be invested back into the business’ growth.

Thriday saw the potential to create a solution that would help small and medium businesses save money on financial administration and give them back hours each week to focus on more valuable tasks that help to drive business growth and achieve their goals. Whether it’s a shearer in Northern QLD, or a café owner in inner Melbourne, Thriday can help, and it worked with Experian to make this happen.

Thriday is an all-in-one next-gen financial management platform. Its mission is to become the fastest way for small and medium businesses to manage their banking, accounting, and tax. Thriday is currently experiencing significant demand from Australian businesses.

| Industry: | Financial Services |

Solution overview

The Thriday offer

Thriday’s solution is targeted at business owners who are often burdened by the significant amount of time and cost involved in managing their finances. Research conducted by Thriday highlighted that as well as being time consuming, financial admin was the most disliked activity in running a business.

Thriday solves this problem by combining a smart business account with value-added services like expense management, invoicing, tax forecasting, BAS lodgement and more. Using artificial intelligence (AI) and machine learning (ML), these tools are designed to run on autopilot, winning back time for busy business owners and making it easy for them to stay in control of their finances.

Collaborating with Experian

To deliver on its promise, Thriday knew it had to find a way to automate financial management for businesses, including the ability to automatically categorise transactions using the technology of trusted partners. A critical component to the success of the solution, and for the time and cost-saving benefits to be realised, was that the solution needed to categorise transactions faster and more accurately than the human labour it was replacing, and be trusted.

The Experian solution was the perfect fit. Using Experian’s technology to enrich and automatically categorise bank transactions in real-time, expense management becomes a breeze. Over 1 billion transactions are processed a week with a match rate of over 98% and a response time of less than 0.3 seconds, providing an unrivalled comprehensive dataset for accurate and fast bookkeeping, saving the time of both business owners and accountants. The solution is also API driven and was seamlessly integrated into Thriday’s platform.

Automatically categorise bank transactions in real-time for faster and more accurate decisions

Learn more

Putting the platforms to the test

To get a further sense of Experian’s capabilities, in addition to their previous understanding of the technology, Thriday tested the solution on 50,000 real-world accounts during their beta phase and refined it to a point where it exceeded the accuracy of a human accountant. This increased Thriday’s confidence in Experian’s technology further and has enabled the business to accelerate its growth.

The benefits

Following conversations with current and prospective customers, Thriday discovered that many businesses are spending thousands yearly on financial administration. Thriday charges users just $29.95 a month, allowing businesses to slash the costs of their financial administration while also saving six hours of precious time each week.

Thriday sees its platform as serving a similar purpose to a personal trainer. A personal trainer can provide tailored advice, but trainees don’t need to count the number of repetitions that one does at the gym. Similarly, businesses may go to an accountant for advice, but using Thriday means clients don’t need an accountant to manually sort through and categorise transactions. This saves everyone involved time and business owners can drastically reduce their financial administration bills.

Automatically categorised transactional data has also enhanced the Thriday platform by providing business owners invaluable insights into their cash position at any time. By accessing comprehensive reporting available in the Thriday platform, such as income statements, cash flow and balance sheets, they can better understand their income and expenses.

While the Experian solution is often seen as a consumer-orientated solution due to its dominance in the retail banking space, Thriday’s success shows its value to other industries such as accounting.

“There are over a million merchants in Australia who might appear 80 million different ways on bank statements. We have a rich and powerful solution that enables Thriday to focus on creating the best experiences for their SMEs that they can trust for managing their finances.” – Simone Jemmett, Managing Director, Open Data Solutions

- Improved user experience with enriched bank transactions for instant clarity on spend

- Fast and accurate bookkeeping with automatically categorised bank transactions in real-time

- Enhanced comprehensive reporting for invaluable insights into their cash position at any time

Would you like more information?

Speak to an expert