Topics include:

- Why data is important for rapid digital transformation

- Was the data ready for a pandemic-driven market

- How to prepare your data for the future

- 93 percent of companies had data management issues as a result of the global health crisis. How will you solve your data challenges?

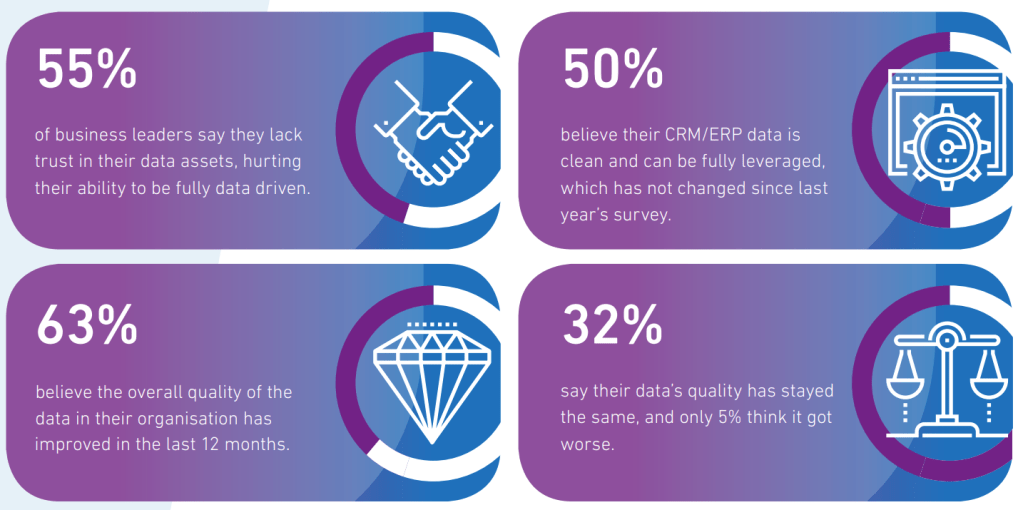

Trustworthy data has provided businesses a stable foundation, even in economic distress. Building resilience on data can protect businesses now and in the future. Today is the day to be data-driven.

Loading...