This blog has been compiled with data sourced from the illion Consumer Bureau*

By leveraging Experian’s expansive bureau data, we can aggregate insights down to mesh block levels (30 to 60 households), revealing detailed, location-based intelligence that goes far beyond traditional credit data.

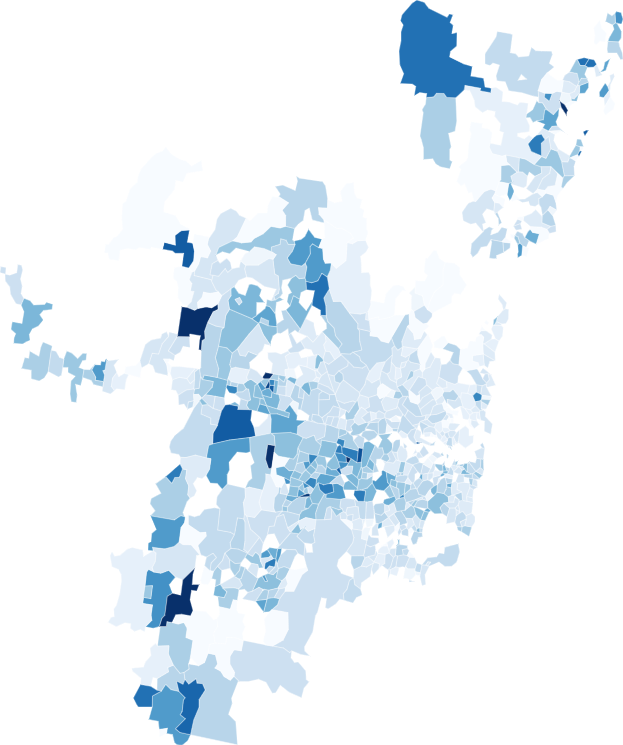

| Where Sydney homeowners are behind on their mortgage repayments

% of home loans that are 30+ days past due Current % 0.1

|

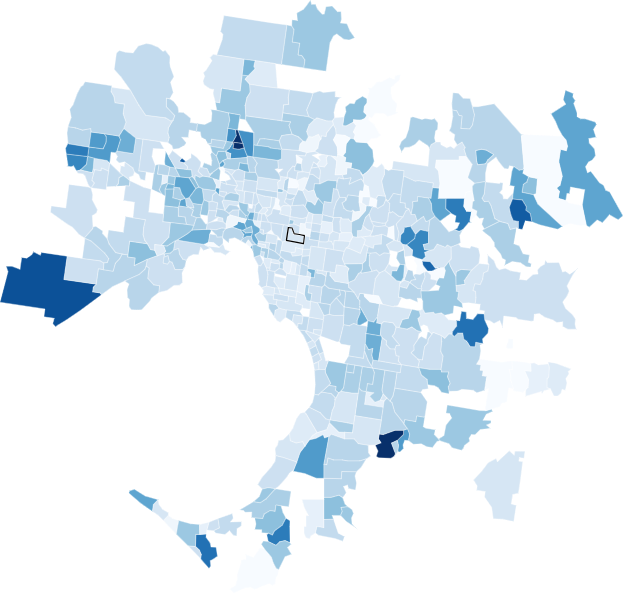

Where Melbourne homeowners are behind on their mortgage repayments

% of home loans that are 30+ days past due Current % 0.1

|

With a customer address, you can unlock a rich profile of the location’s demand, spend, income, credit risk, and collections history—giving you the tools to proactively support customers who may be experiencing financial hardship.

Tap into a Range of Unique and Powerful Hardship Insights

Geographic Risk Index (GRI)

GRI measures the likelihood of default relative to the Australian population. It assigns a score from 0 (Worst) to 100 (Best) based on the concentration of credit risk behaviours in an area. This helps identify high-risk regions and tailoring hardship support programs accordingly.

Credit Demand Index (CDI)

CDI forecast the likelihood of credit enquiries across different types (e.g., personal loans, telco, utilities), helping businesses understand which areas may be under financial pressure or actively seeking credit solutions.

Real-World Applications for Hardship Strategy

Geo Attributes is already helping businesses across Australia to build smarter, more compassionate hardship strategies. Here’s how:

Early Identification of At-Risk Customers

Use GRI and Geo Centrelink to help you identify geographic areas with high concentrations of financial stress. This allows you to engage with vulnerable customers before payment issues escalate.

Targeted Communication and Support

Avoid blanket messaging. Geo Attributes help you focus hardship communications only on relevant segments—saving on servicing costs and improving customer experience.

Regulatory Compliance

Meet obligations under frameworks like the National Energy Customer Framework (NECF) by identifying hardship early, offering tailored support, and ensuring disconnection is a last resort.

Enhanced Customer Segmentation

Geo Attributes enable segmentation based on financial vulnerability, allowing you to tailor products, services, and support programs to different customer needs.

Support for New-to-Bureau Customer

For customers with limited or no credit history—such as Gen Z or recent migrants—Geo Attributes provide a proxy for risk, enabling responsible onboarding and support.

Forecasting and Planning

Understand the potential impact of hardship programs on revenue and customer behaviour. Geo insights help you model scenarios and plan for financial contingencies.

Industries that can benefit from Geo Attributes

Geo Attributes is used across a wide range of sectors, including:

- Financial Services

- Telecommunications

- Utilities

- Government Departments

- FMCG

- Digital Platforms

- Healthcare

- Education

- Insurance

- Social Housing

Whether you’re managing risk, planning outreach, or fulfilling regulatory obligations, Geo Attributes offers location-based insights that support informed and empathetic decision-making.

Contact us to learn more

*illion Pty Ltd is now an Experian company

Disclaimer: This blog is provided by Experian Australia Pty Ltd (“Experian”) as general information and it is not (and does not contain any form of) professional, legal or financial advice. Experian and its related bodies corporate make no representations, warranties or guarantees that the information (including links and the views/opinions of authors and/or contributors) contained in this document / report / email is error free, accurate or complete. You are solely responsible and liable for any decision made (or not made) by you in connection with the information contained in this document / report / email. Experian (and its related bodies corporate) exclude all liability for any and all loss cost, expense, damage or claim incurred by a party as a result of or in connection with (whether directly or indirectly) this document / report / email or any reliance on the information in this document / report / email or links contained within. Experian owns (or has appropriate licences for) all intellectual property rights in the information and this document / report / email must not be edited, copied, updated or republished (whether in whole or in part) in any way without Experian’s prior written consent.