As Australians continue to grapple with rising living costs, a recent webinar hosted by Experian Marketing Services shed light on how different households are experiencing and responding to this pressure. Drawing from Experian’s newly rebuilt Mosaic segmentation model and innovative Spend Analytics tool, we explored consumer behaviour in the face of economic strain.

Income growth outpaced by inflation

Over the past year, the Consumer Price Index (CPI) rose between 2.5% and 4%,1 with employee households – those reliant on wages and salaries – seeing a sharper 6.2% increase.1 This was largely driven by higher insurance premiums, mortgage rates, and financial services costs.

The CPI also reflected persistent inflation, particularly in housing, food and beverages, and recreation. These increases have placed significant pressure on household budgets, especially among lower-income Australians, who have seen rent increases of up to 15%.

Financial behaviour reveals growing stress

Experian’s Consumer Stress Barometer added another layer to the picture, revealing a rise in ‘supplemented spending’, with more consumers turning to buy now pay later services. Many households are also reducing insurance coverage to cut costs, a risky move that underscores growing financial vulnerability.

Mortgage stress remains a key issue, with rental increases disproportionately affecting lower-income renters. Personal loan usage has risen by 2.5%, often a red flag for financial hardship. Defaults are also climbing, particularly among younger Australians and those nearing retirement.

Identifying cost-of-living vulnerability by household type

To better understand how these pressures affect different types of households, Experian combined its Mosaic segmentation with Spend Analytics data to create a ‘Cost of Living Impact Score’. This score ranks household types based on their vulnerability to cost-of-living increases, factoring in income, housing costs, and household size.

At the least impacted end of the spectrum are high-income, asset-rich groups such as Mosaic Group A (affluent households) and Group B (young, professional couples). These households are generally well-insulated from economic shocks.

On the other end are groups like Group J (solo budgets) and Group H (frugal families in outer suburbs), who are more exposed due to lower incomes, higher housing costs, and larger household sizes. Regional groups like Group K (small towners) also face challenges, particularly due to higher food costs outside metro areas.

Financial pressures vs lifestyle choices: What Australians are still spending on

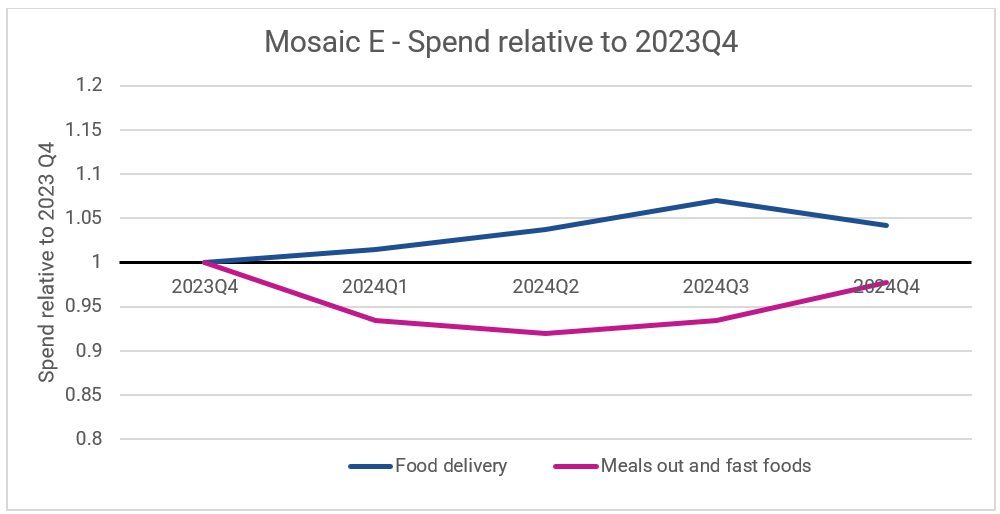

Despite financial pressures, many Australians continue to prioritise certain discretionary spending. For example, Group E (millennial families in growth suburbs) still spend significantly on holidays and pre-made meals – likely a reflection of their time-poor lifestyles and desire for family experiences.

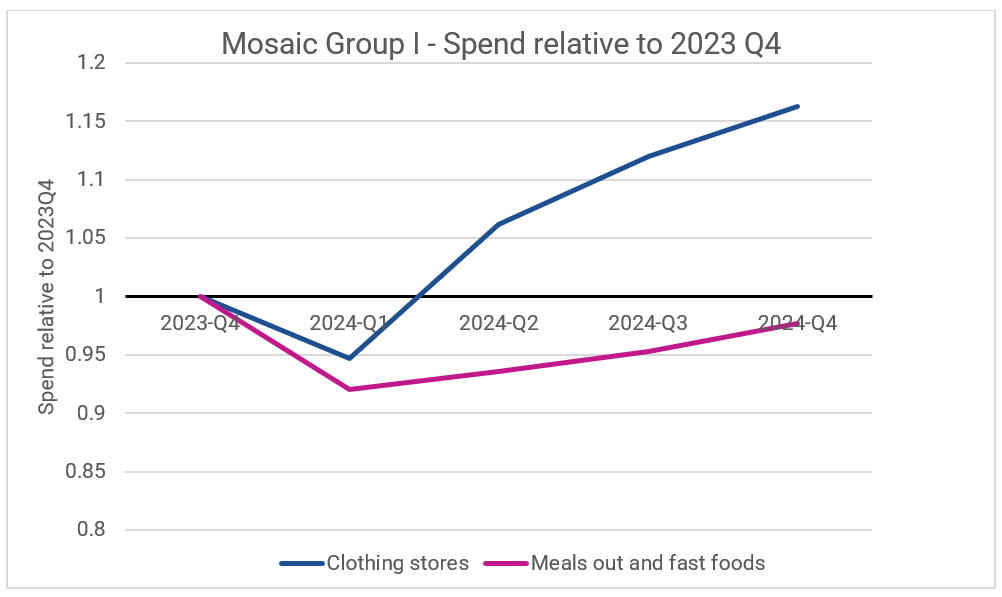

Young renters in Group I (dream chasers) are spending more on clothing and live events, while Group F (middle Australia with teenage children) shows a preference for food delivery and dining out. These spending patterns reveal not just financial behaviour, but also lifestyle values and coping strategies.

Optimising your customer strategy in three steps

Experian recommends a three-step approach to businesses looking to leverage these household spending insights:

- Profile Your Customer Base

Use Mosaic to understand which segments dominate your customer base and how they are affected by cost-of-living pressures. - Prioritise Key Segments

Focus on the top two or three Mosaic groups that over-index for your products or services. - Personalise Engagement

Tailor messaging and offers based on the unique characteristics and spending behaviours of these groups.

As interest rates begin to ease and inflation shows signs of slowing, there is cautious optimism. However, understanding the ways in which different households are navigating these challenges remains critical for businesses aiming to connect meaningfully with their customers.