Businesses are increasingly focused on understanding potential risks within their customer base.

However, beyond historical payment information, businesses often have limited visibility into the financial risks or pressures faced by segments of their customer base. This limited view can then hinder the ability to understand and address which customers might be at risk of facing financial hardship. Financial hardship refers to situations where customers struggle to meet their payment obligations due to various pressures, such as economic downturns, personal financial challenges, or larger unexpected expenses.

Customers are often unaware of the programs and support available to them from suppliers, which can exacerbate issues with payment or potential defaults during times of difficulty. The Australian Energy Regulator has been active in enforcing hardship protections, issuing heavy penalties for ineffective hardship and payment plan protections.

Across Australia the National Energy Customer Framework (NECF) governs protections for consumers experiencing payment difficulties. Under the NECF, energy retailers must:

- Identify and engage with customers facing payment difficulties early.

- Provide tailored assistance based on individual circumstances.

- Ensure disconnection is a last resort.

Similar financial hardship policies apply in other industries, such as telecommunications, banking, insurance, education, superannuation, social housing, healthcare, legal services and more. These policies aim to provide support and protection to consumers facing financial difficulties, ensuring they receive the necessary assistance to manage their payments and avoid severe consequences like disconnection or default.

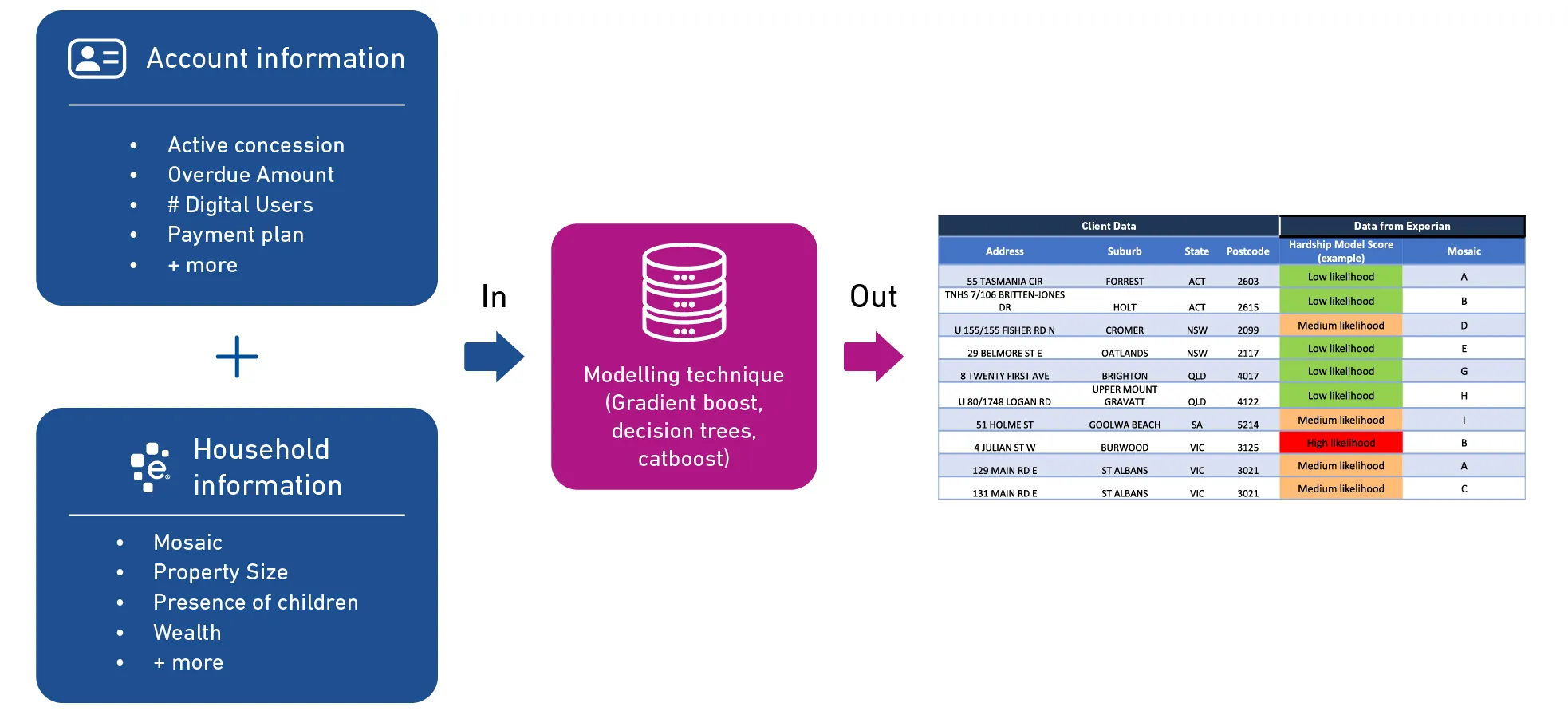

Experian Marketing Services has recently helped a number of businesses in establishing a Hardship Scoring Model or Payment Difficulty Framework to help understand which customers could be facing hardship, and what measures might assist those customers in need.

The Challenge our client faced

- A limited view of their customers

- Crucial household demographic information didn’t exist, and is hard to obtain

- Limited ability to identify people likely to face hardship, and compare these customers to others.

- Customers unaware of support options offered by their provider, typically these options should only be put forward to relevant customers.

The Solution

General business customer information from the client, such as household address and email, are matched with Mosaic data points. Experian’s Mosaic then provides a 360 degree view of the customer base. Mosaic utilises more than five thousand data variables from a variety of sources to develop a rich and detailed understanding of your customers. Using this insight, Experian models every Australian household to classify them into one of 14 Groups and 52 Types, based on their likely behaviours and preferences.

The Insight

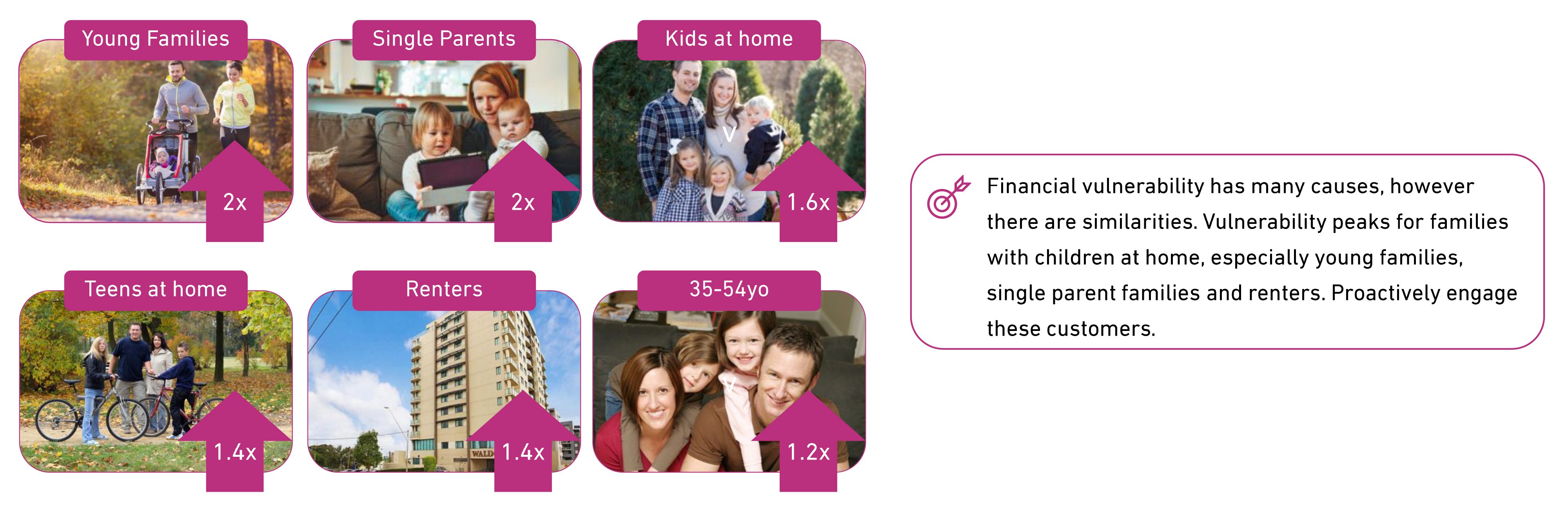

Two key groups of customers were identified within the client’s customer base, those who were flagged as Financially Vulnerable and those who were at Lower Risk. Within the Financially Vulnerable group were segments such as ‘Young Families’ and ‘Kids at Home’. Selected ‘Young Families’ within the customer’s dataset were identified as two times more likely to be facing financial hardship.

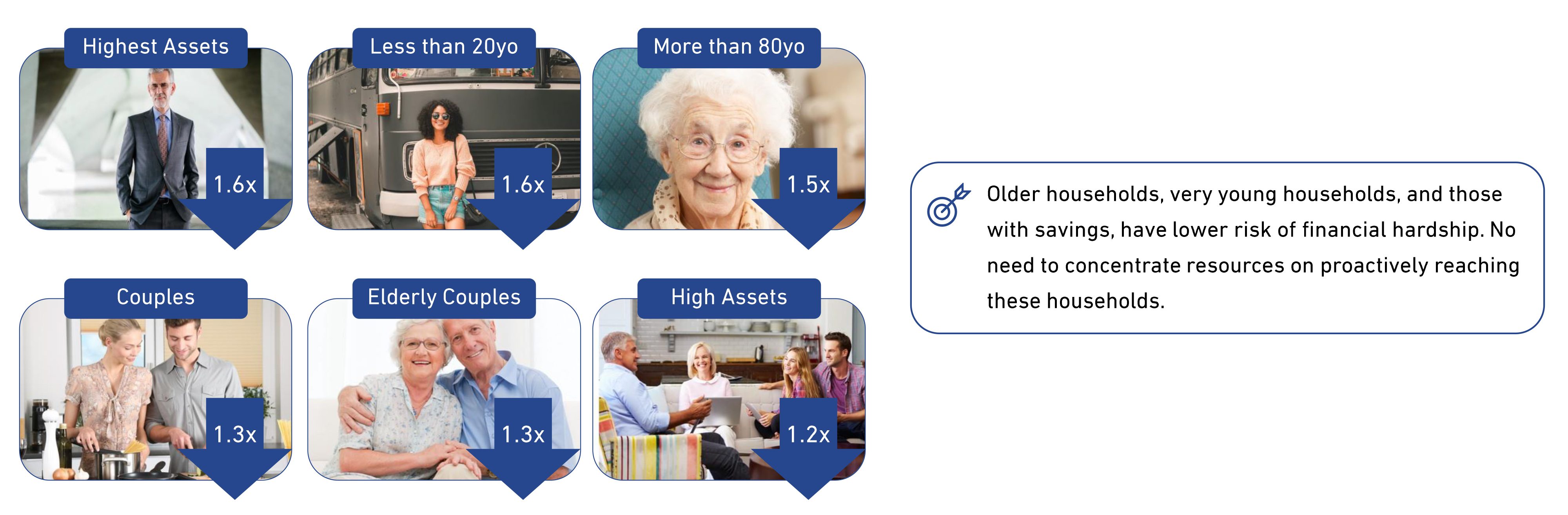

While within the Lower Risk group those with High Assets and under the age of 20 showed 1.6x less likely than the average to experience financial hardship. Aside from understanding the scoring of your customer base, Mosaic provides you with the insight on the profile of customer being identified.

Financially Vulnerable

Lower Risk

The Results

3% of their customer base was identified as ‘Hardship Red’, while a further 13% were flagged as ‘Amber’ meaning approach cautiously as they may be in hardship.

Just 16% of their customer base was flagged, meaning 84% of the base could be left out of customer communications. A huge saving for the business on customer servicing costs.

Key Client wins;

-

4,000 customers from their debt book recouped as active customers

-

$1.3million debt recovered over 6 months

If you’d like to understand more about how Experian Marketing Services can help you fulfill your Financial Hardship obligations, please reach out below.