As the first Christmas television adverts touch our screens and Mariah echoes from your favourite radio station, the retail industry rightly has one eye focused on the operational challenges and implications of the influx of trade that the holiday period brings. Retailers have long since finished their strategic planning for Christmas and are now entering a pure execution mode, where website code freezes, promotions, and the physical workforce all play a critical role.

Understanding how and where consumers shop is more important than ever.

This is even more critical for Retailers who still rely on a strong physical shop trade. How do they evaluate store performance? How and where do they plan to open new stores? Where should they focus their much-pressured advertising budgets?

In this article, we explore what consumers look for in a physical shopping experience and share location insights based on demographics.

Real insights about real shopping locations

Understanding customers’ profiles and their purchasing behaviour is of critical importance for businesses in the retail industry. Experian’s Retail Dashboard offers comprehensive insights into merchant categories in shopping centres across Australia, bringing to life the shopper profiles overlaid with Experian’s Mosaic and their spending preferences across various categories. This tool allows retailers to gain a high-level understanding of shopping centres and consumers’ behaviour, as well as provide data-based guidance for their business strategies.

Some of the key use cases of this dashboard for retailers includes:

- Facilitate store expansion – which shopping precincts have the right profile mix?

- Evaluate existing stores – what do people who visit my current locations like to spend on? Are we maximising our engagements with them?

- Out-of-home advertising – which shopping centres should be prioritised for billboard placements.

The information shared in this article today was all derived from our Retail Dashboard.

What characteristics do consumers look for in an ideal shopping centre?

As we have discussed, over recent years Australia’s shopping habits are becoming more digital. But, online shopping still only accounted for 12.6% of all shopping in 2022. There is clearly life in bricks & mortar shopping locations yet, although strategic decisions about location have become even more important.

Typically, these are the characteristics Australians look for in a shopping destination:

- Shopping location is easy to get to

- High ratio of shopping merchants, especially clothing

- High level of brand affiliation

The most prevalent shopping centres for high spenders

The Experian Retail Dashboard can help us identify, for example, where Australia’s most affluent consumers like to do their shopping.

By comparing Australia’s most popular shopping locations with Experian’s most affluent socio-demographic group (Mosaic Group A – ‘First Class Life’) we can see that the following locations have large concentrations of these wealthy Australians:

New South Wales

- St Ives Shopping Village & surrounding

- Westfield Warringah Mall

Western Australia

Victoria

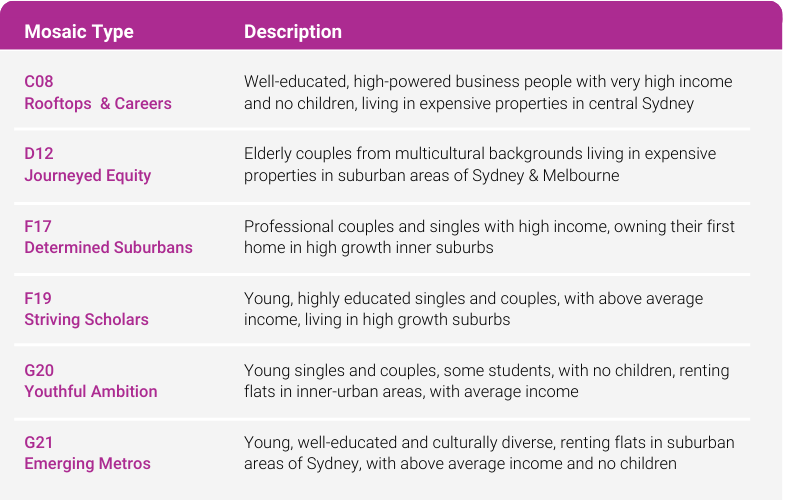

Another interesting finding from the dashboard is that, apart from Mosaic Group A (‘First Class Life’), the other most common Mosaic types of these shopping centres are very consistent with each other, mainly clustered around Mosaic Types C08, D12, F17, F19, G20 and G21. These mosaic types share very similar purchasing habits with Mosaic Group A.

Despite different affluence levels and life stages, these Mosaic types share a common characteristic – they have average to high incomes and no children in their households. Their discretionary income is therefore higher and they mirror the habits of more affluent groups.

According to the dashboard, these Mosaic types tend to spend more on clothing and apparel, as well as household products. Our data also shows that although the annual total spend of these people may not be substantial, their average transaction value on clothing, footwear and homewares are generally higher than other types.

Therefore, for retailers specialising in high quality and premium goods, particularly in clothing, footwear and homewares, this represents an opportunity to broaden their focus beyond just Mosaic Group A.

How Experian’s Retail Dashboard helps make better decisions

The power of the Retail Dashboard lies in its ability to help organisations make faster, smarter strategic decisions. By providing deep analysis of consumer profiles, layered on top of their spending habits at real, physical shopping locations, retailers have all the tools they need to grow their physical presence in the right way.

Below is an example of how Experian’s Retail Dashboard could help an organisation understand where they should focus.

Retailer A, specialising in women’s clothing with a section for children’s clothing, was considering expanding its business from Queensland to Victoria and New South Wales, but lacked the insights to make any informed decisions.

The Experian team worked with Retailer A to provide an extensive analysis, assisting them in identifying their best performing stores and recommending a few prospective shopping centres with similar characteristics.

Based on their historical sales data, their best performing store is located in Westfield Carindale Shopping Center, Queensland. Using the dashboard, we can gain a deeper understanding of the merchant categories and most prevalent shoppers at this shopping centre, along with insights into their purchasing behaviours.

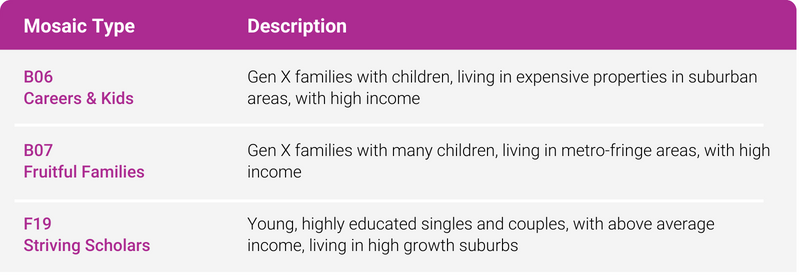

The most common shoppers for this shopping centre include Mosaic types B06, B07 and F19. These shopper profiles traditionally have high spend on clothing and apparel, especially women’s clothing and children’s clothing.

After selecting target segments as B06, B07 and F19 and filtering the geographical location they are most interested in, we can identify the top shopping centres that align with this criteria.

By evaluating the most prevalent mosaic types, the ratio of shopping merchants and shoppers’ propensity to spend on specific categories, Narellan Town Centre, NSW and Westfield Fountain Gate, Victoria stand out to be the most suitable location for new stores.

Why is Narellan Town Center a promising location?

- 1 in 7 shoppers at Narellan Town Centre are from B07, a key lookalike Mosaic, making them the largest cohort of consumers.

- 54% of the merchants in the shopping centre are shopping-related, which is 1.2 times more likely than the average level. Among all the merchants selling shopping related items, 36% are clothing merchants, while they also index highly for Jewellers and Home specialists.

- The most prevalent Mosaic types are 1.27 and 1.1 times more likely to purchase children’s clothing and women’s clothing, respectively.

All the data you’ll need to make the best shopping location decisions.

The Experian Retail Dashboard provides a lens into shopping centres across Australia. Along with Mosaic variables, it significantly enhances businesses’ understanding of their stores. Furthermore, its ease of use helps retailers scale up and expand into new locations more effectively.

If your business is in the retailing industry and you’re looking to make data-driven decisions to boost your business, please get in touch today.