Our Global Decisioning Report 2021 looks at how consumers are stabilising their finances and how businesses are returning to growth.

The research, comprised of three waves of data collected from June 2020 through to January 2021 among 9,000 consumers and 2,700 businesses across ten countries worldwide, reveals the importance of lenders prioritising digital transformation, and the role of advanced data and analytics in enhancing the customer experience.

The ebbs and flows of the pandemic are reflected in Australian consumer spending

With consumer finances in a state of flux, navigating this varied credit landscape requires a deep understanding of customer needs on both ends of the spectrum. However, business confidence in the consumer credit risk management analytics models for example dropped 14% from October 2020. With only 58% of businesses feeling confident in their models, 75% were looking to either recalibrate and improve existing models or rebuild them from scratch.

Implementing data and analytics to assess financial health and risk profile

Recalibrating credit models is one thing, but lenders also need to rethink their data sources to better understand current customer profiles. The data inputs generated by the pandemic have impacted credit risk models and machine learning applications in unexpected ways. For example, widespread payment holidays and government stimulus programs may be masking customers’ true financial circumstances.

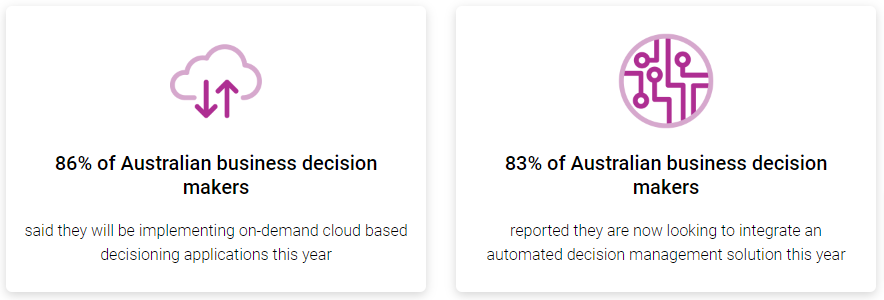

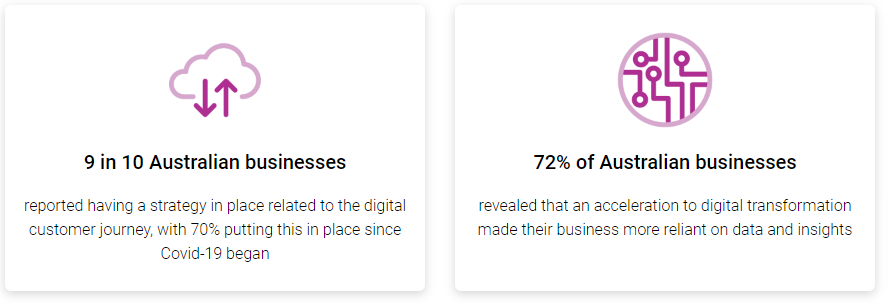

Businesses fast tracking digital transformation to meet consumer expectations

In the early stages of Covid-19 we vaulted five years forward in consumer and business digital adoption in a matter of eight weeks. The importance of a digital-first approach has become evident throughout the pandemic, with Covid-19 creating a seismic shift in the volume of online activity.

The future, however, is more than providing online services. It’s about knowing your customers well enough to anticipate their credit needs and using tools to automate the process and reduce risk.

Online customer experience and credit risk management are more connected than ever before. Businesses need technology that supports the entire customer journey, from acquisition and onboarding to customer management through to collections.

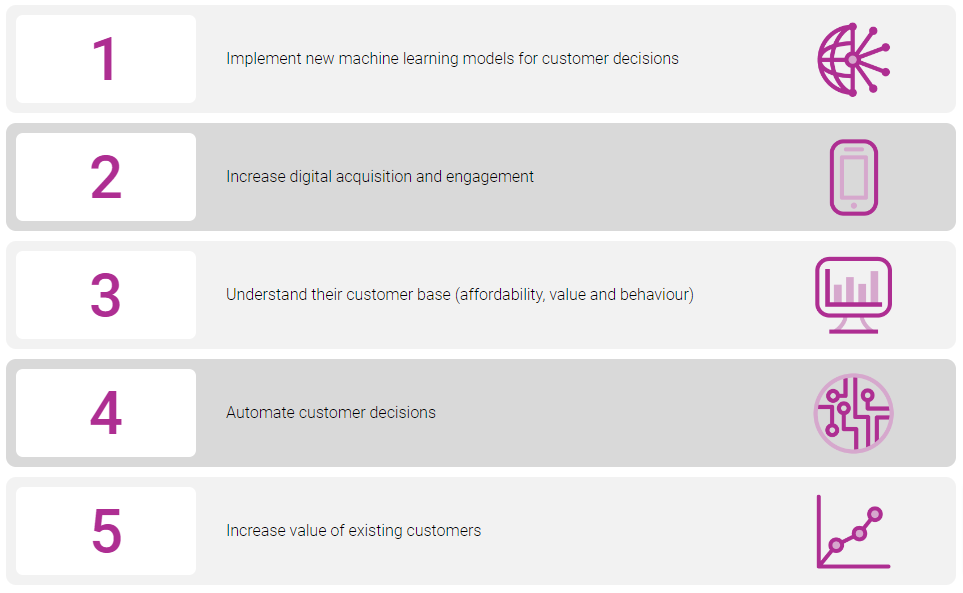

Five digital investments businesses are prioritising the new era of credit risk management:

Download the report to get more consumer trends and find out what the future of decisioning means for businesses looking to return to growth.

If we can assist your business in navigating a new era of credit risk decisioning, please get in touch with us using the form below.