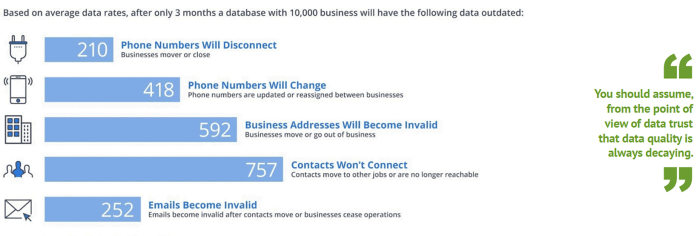

Treating data as a strategic asset is fundamental to both data-driven initiatives and digital transformation. It is also essential to enabling the democratisation of data across the enterprise so that everyone in the organisation can leverage data that they trust. A key impediment to trusting the data is managing data decay.

Data quality tools from Experian help organisations treat data as a strategic asset. Our data preparation capabilities ensure you have the right data, robust data quality capabilities ensure the information is trusted, and persona-based experiences ensure usability and collaboration across teams.

Complete your information below and learn more about treating data as an asset in this White Paper by Bloor.

Loading...