The strong focus on this technology is understandable within the context that fraud losses are increasing for many organisations, with 61% of Financial Services and 48% of Telcos expecting their fraud losses to increase in the year ahead.

A similar percentage (59%) admit that their organisations are struggling to keep up with the rapidly evolving fraud threat. These findings indicate that there is a significant gap between fraud prevention capabilities and the threat posed by complex fraud attacks.

This is where ML steps in, as it can provide more accurate fraud detection than rules alone. Not only does it power transaction monitoring models, but it also provides the analytical foundation for using device and biometric data in fraud prevention.

This article breaks down the top fraud priorities for 2025 and explores the reasons why each one of these priorities has made it into the top five.

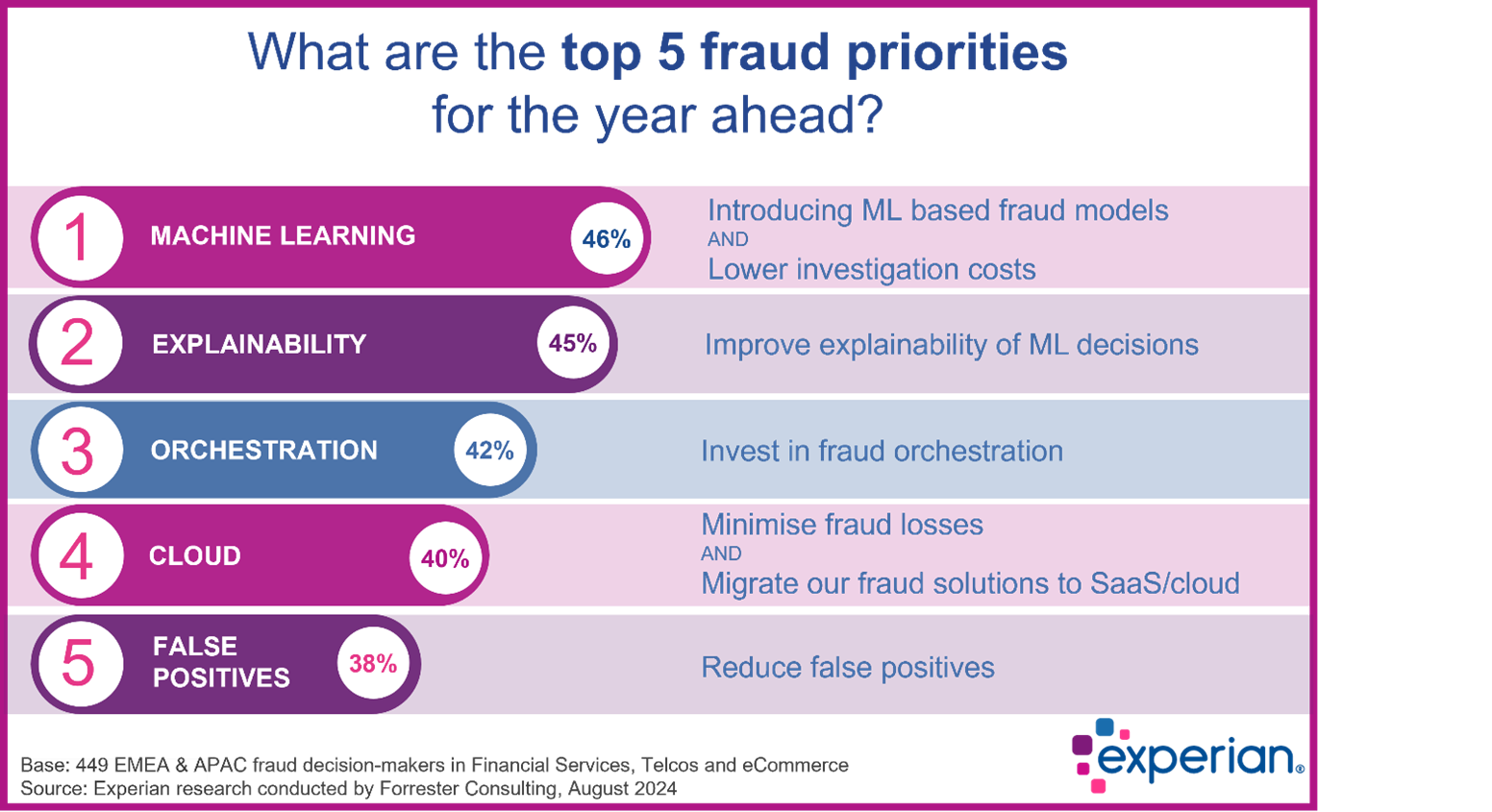

Top five fraud priorities for 2025

The graph below shows the top fraud priorities for the year ahead. Let’s take a closer look at each one to better understand why senior fraud decision-makers are prioritising these capabilities.

Priority 1: Introducing ML-based fraud models and lowering investigation costs

Fortunately, these two priorities work hand in glove as introducing ML fraud detection models allows businesses to automate more applications or transactions. This can help to lower investigation costs as it reduces the effort and expense associated with high volumes of manual reviews.

As fraud attacks become more complex, fraud leaders are looking to ML to help them strengthen rules-based fraud prevention. One of the primary benefits of ML models is that they can be regularly updated on new fraud types as they emerge, which means they are continually improving.

Close to three-quarters (71%) of our survey respondents agree that ML is critical to stay at pace with a growing fraud threat. However, simply using ML does not guarantee an improvement in fraud detection accuracy, as the volume and quality of the data used to train the model make a fundamental difference in its effectiveness.

This challenge was highlighted in research, with more than half (53%) of businesses admitting that they are struggling to implement ML. Pre-trained and verified ML models offer an off-the-shelf solution that can greatly reduce the time to positive ROI, compared with developing a successful model in-house.

Priority 2: Improving explainability of ML decisions

The explainability of ML models is an essential part of their adoption as it allows businesses to understand why the model has made a decision. This information is critical to build trust in the accuracy of ML outputs and also to provide the reasons why an application or transaction has been declined to internal auditors or regulators.

In the past many ML decisions were hidden in a ‘black box’, and while this still applies to certain types of AI algorithms, Experian’s ML fraud models are all fully transparent, with reason codes that break down the value of each contributing feature for every ML decision.

As regulations around the use of ML-based decisioning tighten, fraud leaders are increasingly focused on ensuring the explainability of the models they use. Fortunately, the technology that makes these decisions understandable is readily available and can be retroactively applied – even for previously difficult-to-interpret algorithms like neural networks.

Priority 3: Investment in fraud orchestration

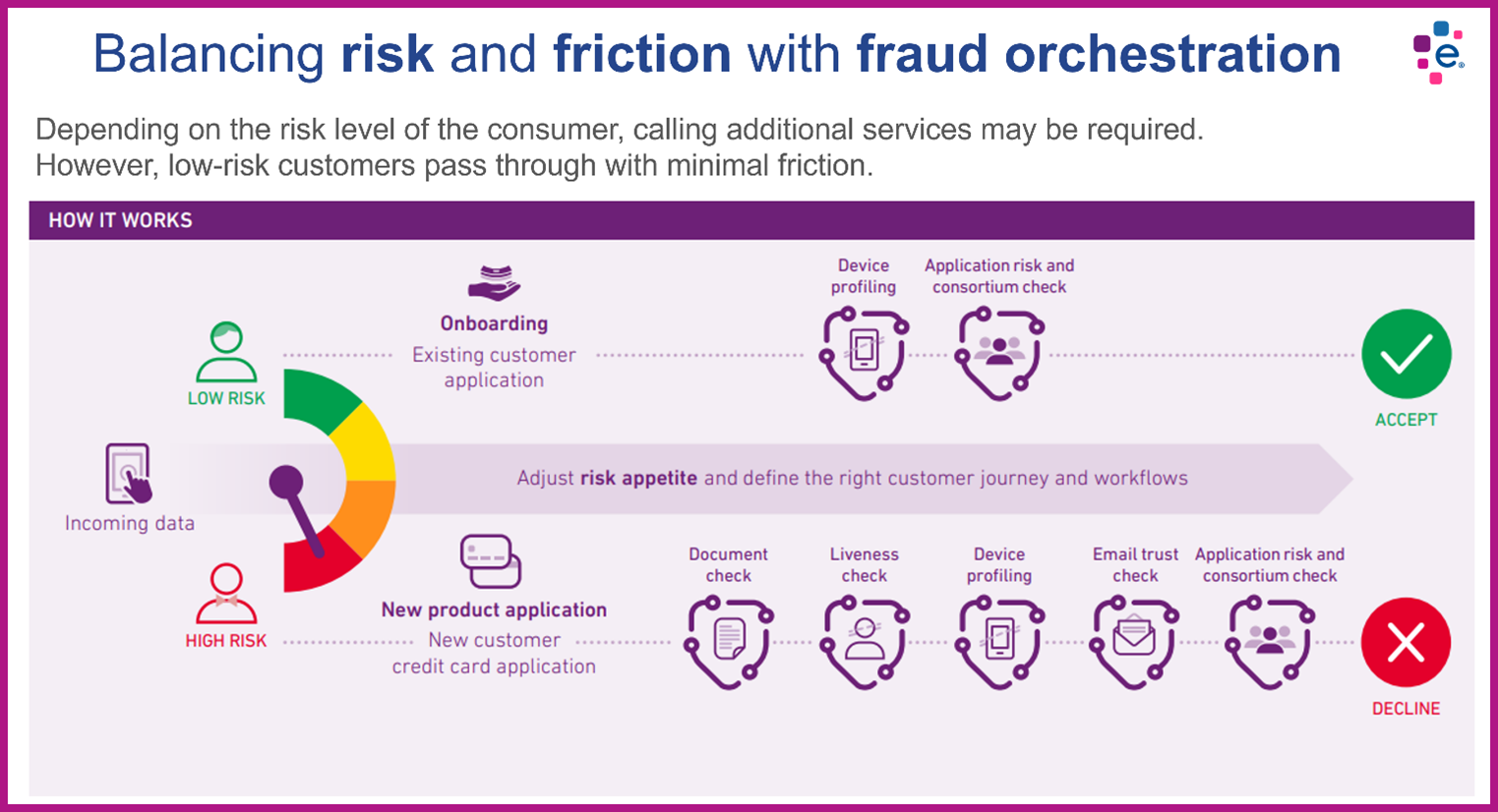

The ability to orchestrate multiple fraud solutions by combining their outputs into a single decision is the third biggest fraud priority for 2025. This capability is becoming more important as more than three-quarters (76%) of businesses use multiple fraud solutions from different vendors.

However, over half (58%) of these organisations do not currently connect these different fraud signals into a single decision. This puts them at a disadvantage as no individual fraud solution can detect fraud with 100% accuracy, yet when the outputs of multiple solutions are combined, the resulting decision is much more accurate.

Using a fraud orchestration platform means businesses can significantly improve their fraud detection rate, while also reducing false positives and improving customer experience. Equally important to these benefits is the reduction in costs that orchestration allows.

By dynamically calling fraud services based on the risk level of the customer, businesses can approve low-risk applications without needing to call their full suite of fraud services. Similarly, when the fraud risk is above a certain threshold, the application can be declined without calling all available services. This directly addresses the number one priority identified in our research – lowering investigation costs.

In the next twelve months, two-thirds (66%) of the organisations we surveyed plan to increase the number of fraud solutions they use. Considering this, it’s clear why fraud leaders are looking to orchestration to manage the complexity involved with optimising multiple fraud solutions.

For those businesses already using orchestration, 72% state that it has helped them reduce false positives, and 69% believe it has increased their operational efficiency.

Priority 4: Migrate fraud solutions to SaaS / cloud

There are many benefits associated with cloud-based fraud detection. These include automatic software updates, better security, increased processing power and elastic storage scalability. Another critical feature to consider is that cloud acts as an enabler for ML.

The performance uplift in fraud detection accuracy that ML provides is dependent on the ability to access and connect to large amounts of data in a secure way. Cloud makes it easier to connect to multiple large databases, which are essential to compare transactions or applications with historical cases.

For those organisations that have yet to implement ML-based fraud prevention solutions, perhaps the biggest advantage of migrating to cloud is the plug-and-play functionality. This technology allows them to achieve more accurate fraud detection in a matter of days, no matter what their current IT capacity is.

Priority 5: Reduce false positives

False positives remain a significant challenge for many organisations, and our research reveals that a staggering 61% of respondents report that false positives cost them more than fraud losses. There are several potential causes of this but at the heart of the problem is the accuracy of fraud detection systems.

Rules only fraud prevention is notoriously inaccurate, and as more rules are added to respond to new fraud threats, the result is often a lack of precision. This means that both good and bad customers are incorrectly flagged, which increases the volume of manual reviews and ultimately impacts profitability.

The good news is that fraud detection accuracy can be significantly improved with the right tools.

This means far fewer transactions are misclassified, so good customers pass through with minimal friction and fraudsters are stopped in their tracks. On top of that, the volume of manual reviews is massively reduced, allowing fraud investigators to focus on fine-tuning while also reducing costs.

What’s your business’s top fraud priority for 2025?

As the fraud monster continues to mutate, it’s clear that two capabilities are top of mind for fraud leaders. The introduction of Machine Learning and the ability to orchestrate multiple fraud solutions are vital to strengthen defences without impacting revenue.

If you would like to explore our latest fraud research in more detail, click here.