The impact of AI on customer experience

Today’s consumer has more options and less patience than ever before. In this highly competitive landscape, fast and efficient customer experience has become the linchpin of digital customer acquisition for Financial Services and Telco providers. Experian’s latest AI research – conducted by Forrester Consulting – shows that 63% of Australian business leaders we surveyed believe that AI has enhanced their customer experience (CX). There are a multitude of ways that AI can improve CX, including faster and more accurate decisions, personalised offers, and providing instant access to support.

This article examines some of the key findings from our research to help businesses take advantage of the opportunity that AI represents. As online interaction becomes more widespread, this technology is proving to be a critical link between digital convenience and personalised support.

How do businesses rate their own customer experience?

To better understand the relationship between AI adoption and CX, we asked nearly 900 senior leaders how they would rate their organisation’s CX compared to their competitors. Although there is likely to be some bias involved with personal appraisals, 37% of respondents believe they are behind and need to improve to equal their competitors. A similar number (38%) believe that their CX is best in class and a key differentiator.

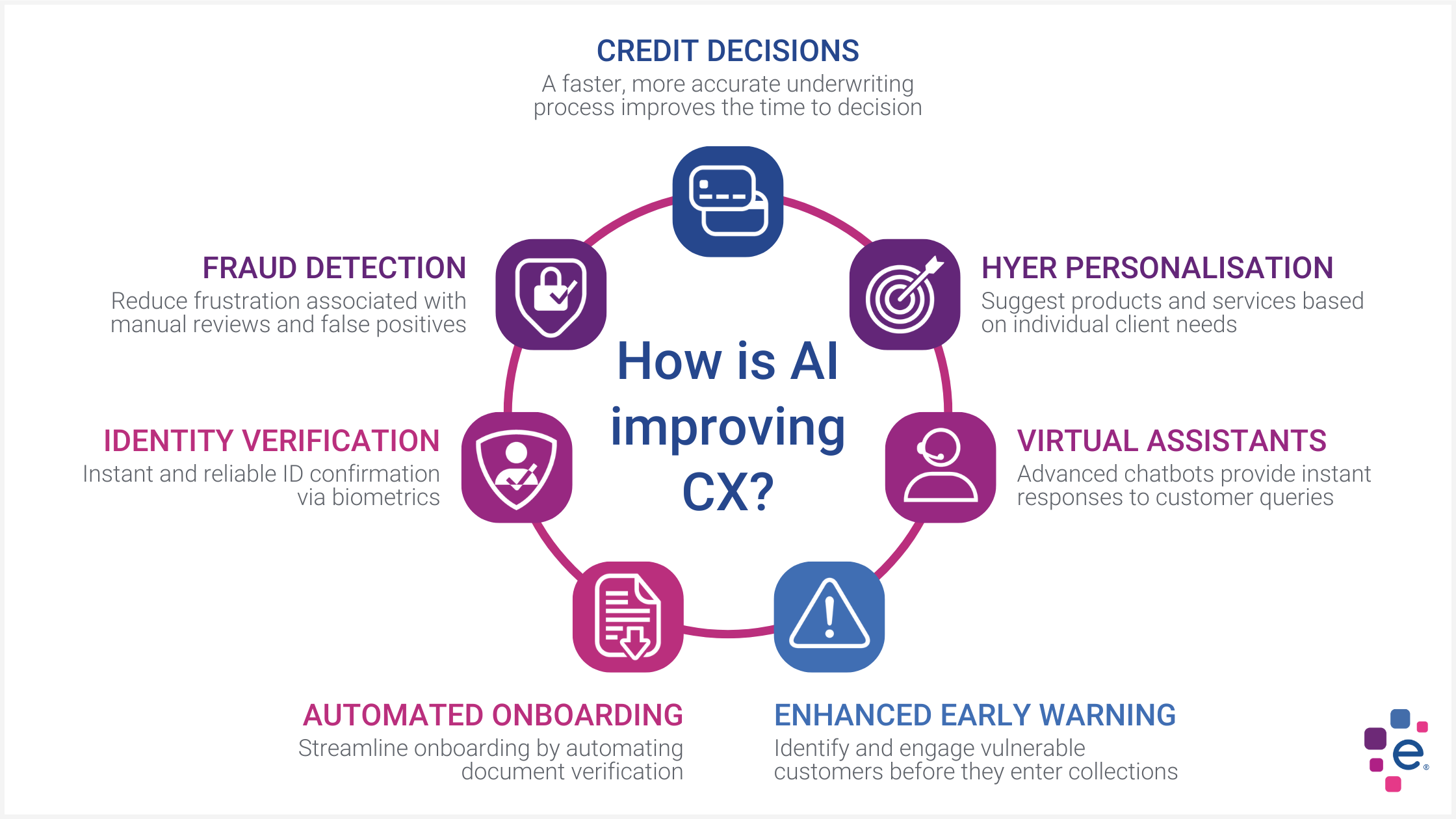

The image below provides some practical examples of how AI can be used to improve CX. Let’s break down each aspect for a more detailed analysis.

Real-world examples of AI boosting CX

Creditworthiness assessment

AI and its subset Machine Learning (ML) can significantly improve the accuracy of the models used to assess creditworthiness and affordability. This accuracy improvement is achieved by the ability of ML to analyse vast data sets with greater analytical power and precision. This accuracy can lead to more inclusive lending, such as customers that may have been declined previously now being approved, as well as more personalised terms being offered by a better understanding of behavioural insight into financial circumstances.

Personalised services

On-going access to Open Banking data means that lenders can use AI to identify cross-sell and up-sell opportunities for their customers. CX is enhanced by providing timely and useful recommendations based on insights gained from analysing transaction data. This could include suggested advice on how to meet financial goals, offers to adjust credit limits based on behavioural data, or providing product recommendations based on needs. Personalised services improve customer trust and loyalty when they are relevant and meet established needs.

Virtual assistants and chatbots

Chatbots are a well-established application of AI within customer service. However, the intelligent language analysis provided by Large Language Models (LLMs) is taking them to new heights. Rather than simply responding to queries, they can now guide customers through various financial processes like opening or closing an account. AI can also augment human call centre agents with faster access to relevant information when speaking to customers.

Enhanced early warning systems

Identifying vulnerable customers before they enter collections is another area where AI can boost CX. Using ML models to identify vulnerable customers by analysing data and then suggesting a personalised restructuring plan that takes their financial situation into account. Customer engagement can also be automated via their preferred communication channel.

Automated onboarding

One of the most critical customer experience touchpoints is onboarding. If this process is too slow or requires too many steps, abandonment inevitably increases. By incorporating the various AI capabilities – such as facial recognition, ML powered Optical Character Recognition (OCR) to automate form filling, and device intelligence for accurate fraud detection – onboarding time and friction can be greatly reduced.

Identity verification

AI-powered digital identity verification, such as facial recognition with liveness detection, provides a fast and highly reliable method to authenticate customers. This quick technique allows customers to verify their identity as per their ID documentation in a matter of seconds for the ultimate fast and seamless onboarding. In addition, device intelligence (that combines device data and behavioural biometrics) can be used to passively verify returning customers with zero interruption of their user experience.

Fraud detection

The improved fraud detection accuracy of ML fraud models has a direct impact on CX through a reduction of manual reviews and false positives. Both of these events can be extremely frustrating for a customer and lead to them abandoning an application or being incorrectly rejected as a fraudster. ML algorithms can more accurately identify genuine customers by analysing behavioural biometrics and device data to detect unusual patterns or anomalies associated with fraud.

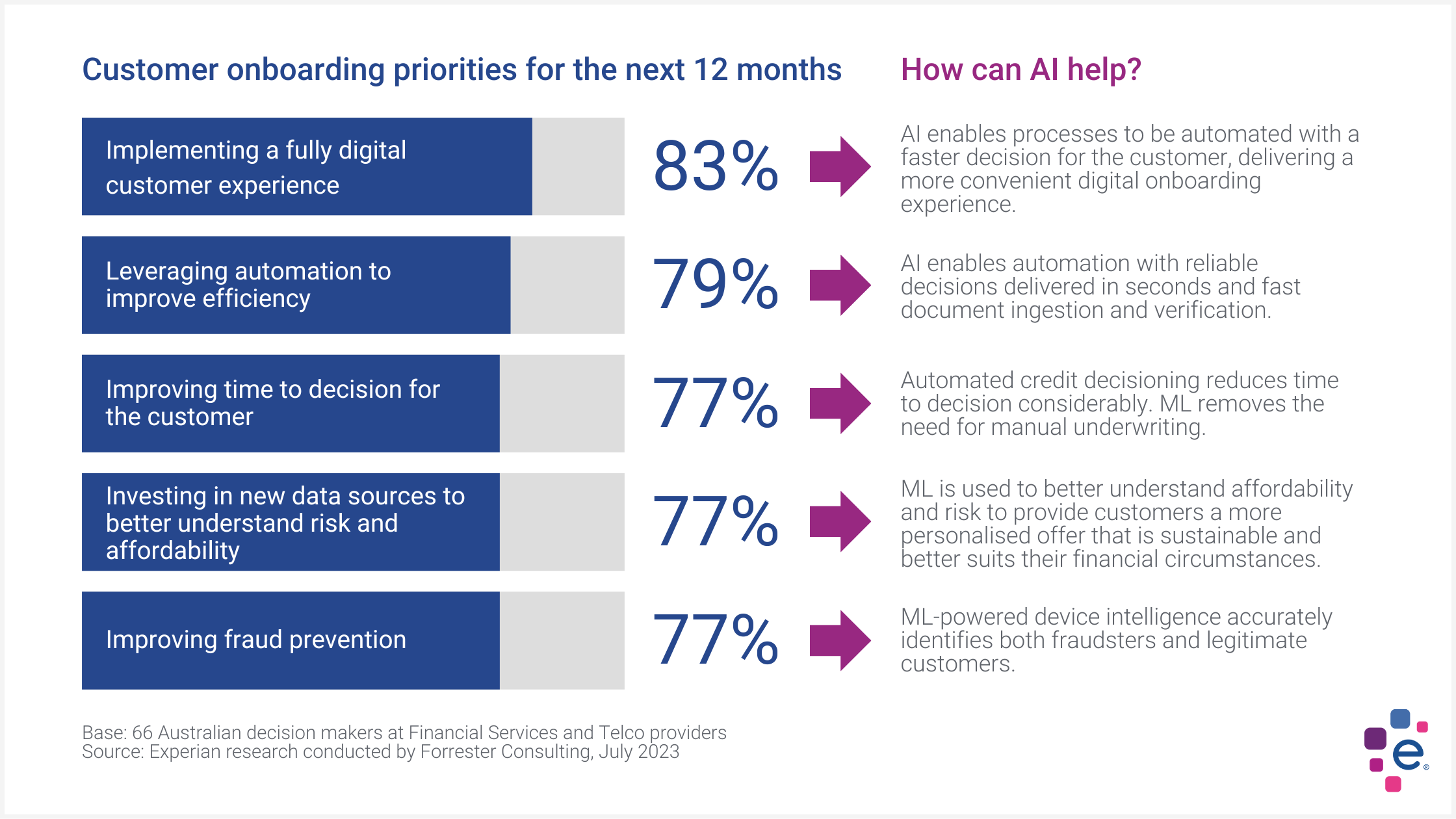

AI to support customer onboarding priorities for the next 12 months

According to our research, the top customer onboarding priorities for Australian senior leaders are:

These findings align with some of the biggest challenges preventing businesses from achieving their onboarding goals – such as slow implementation of AI/ML to improve performance (53%) and lack of new data sources to improve the accuracy of consumer credit decisions (48%). Access to data alone is not enough to improve creditworthiness and risk assessment. Having the right AI tools to analyse this data and turn it into actionable insight is a critical next step.

Providing world class customer experience

Experian has a suite of AI-powered cloud-native software solutions to help you achieve state-of-the-art customer experience. Our global network of experts can help you through each stage of refining your customer experience across the lifecycle by using the latest AI and ML technology.

For more information, please contact us using the form below to speak to an Experian expert. To learn more about how AI is raising the bar for Financial Services and Telco providers, we invite you to read our latest research report. Take a look at our interactive summary where you can also download a complimentary copy of the report.